In addition to paying the franchise tax, businesses incorporated in Delaware must also file an annual report and pay a small filing fee. Certain exempt domestic corporations like charities, civic organizations and religious organizations do not have to pay the franchise tax. The default payment amount listed on your notification is set by Delaware using the Authorized Shares Method, which will almost always result in a much higher amount due for startups with limited assets. There is read fundraising for dummies online by john mutz and katherine murray a helpful Franchise Tax Calculator on the Delaware website to assist in estimating your franchise taxes (note there is a different calculator for each of the 2017 and 2018 tax years). In addition to the franchise tax, there is also a $100 filing fee for the annual report. Non-profit corporations, though generally exempt from the franchise tax, aren’t off the compliance hook.

Authorized Shares Method vs. Assumed Par Value Capital Method

- This method calculates the tax based on the number of shares your corporation has authorized.

- No par value stock is assigned a value of $100 per share for purposes of the above calculation.

- All corporations using either method will have a maximum tax of $200,000.00 unless it has been identified as a Large Corporate Filer, then the tax will be $250,000.00.

- There are several variables that enter the Assumed Par Value Capital Method including the corporation’s gross assets, issued shares, number of authorized shares and their par value.

- Delaware Franchise Tax calculations are prorated if a corporation’s authorized and/or issued shares change during the year.

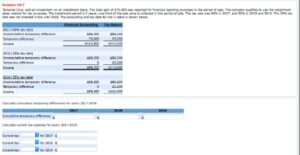

While the typical franchise tax is based on a corporation’s net worth or capital, the tax can also be based on other criteria such as income or gross receipts. The Assumed Par Value Capital Method in the above example results in a much lower tax ($26,800 vs. $170,165). Delaware would automatically show the higher tax due on their website using the authorized shares method.

How to Calculate the Delaware Franchise Tax for Technology & Life Sciences C Corporations

A large widely held public company might have difficulty reducing their authorized and/or issued shares but a start-up technology or life sciences company may have more flexibility. Ideally, Delaware Franchise Tax liability should be quantified prior to incorporating in the state and prior to any new shares being authorized or issued. Franchise taxes are generally due in arrears for the prior calendar year. Understanding and adhering to Delaware’s franchise tax and annual report requirements is important for any business incorporated in the state. Mosey stands out as an invaluable ally in this journey, offering a blend of automation, expert post closing trial balance guidance, and tailored features to ensure seamless compliance. The annual franchise tax report filing has been streamlined into a user-friendly online process.

Method #1: Authorized Share Method (default method)

To use this method, you must provide figures for all issued and outstanding shares and total gross assets in the spaces provided in your annual franchise tax report. Total gross assets shall be those „total assets“ reported on the US Form 1120, Schedule L (Federal Return) relative to the corporation’s fiscal year ending the calendar year of the report. The tax rate under this method is $350 (to be increased to $400 effective for the 2018 tax year) per million or portion of a million.

All corporations using either method will have a maximum tax of $200,000.00 unless it has been identified as a Large Corporate Filer, then the tax will be $250,000.00. In addition to corporations, Delaware limited liability companies (LLCs), general partnerships, limited partnerships (LPs) and limited liability partnerships (LLPs) must also pay franchise taxes. Let’s imagine a Delaware-incorporated company reported total gross assets of $1,000,000 on their federal taxes this year. If you’re trying to figure out if you owe Delaware franchise tax, Bench can help. Our all-star team does your monthly bookkeeping for you and sends your financials to trusted tax professionals for a stress free filing experience. For corporations using the Authorized Shares Method, the minimum franchise tax is $175 and the maximum franchise tax is $200,000.

Large corporate filers, typically those with significant assets and revenue, fall under a special category. These entities, often with stock listed on national securities exchanges, are subject to an annual tax of $250,000. This category is designed for corporations that meet specific revenue and asset thresholds detailed under Schedule L of the tax instructions. The Delaware franchise tax is a mandatory fee that is calculated annually based on one of two methods.

This method is a bit more complicated, because it involves calculating your business’s assumed par value—i.e. Schedule a free consultation to see how Mosey transforms business compliance. Whether you’re a startup or a growing business, Mosey offers the tools and insights to navigate Delaware’s regulatory landscape efficiently.

No par value stock is assigned a value of $100 per share for purposes of the above calculation. Thus, it is generally advisable to avoid no par value stock and to assign a very low par value to shares if possible. For every additional 10,000 shares authorized after that, you pay another $85 in franchise tax, up to a maximum of $200,000. If your company has authorized 5,000 shares or fewer, your total Delaware franchise tax amount is $175. A franchise tax, sometimes called a privilege tax, is a fee you pay for the privilege of doing business in a certain state. create your business plan with planbuildr The annual report’s comprehensive scope captures your business’s essentials, from core operations to finer financial specifics.

They are still required to file an annual report with the Delaware Secretary of State, accompanied by a nominal filing fee. This ensures their continued good standing and operational transparency within the state. As with the franchise tax, registered agents are vital cogs in annual report compliance.

You must file your annual report if your business is a corporation and pay your franchise tax and filing fee by March 1. All LLCs, Limited Partnerships, and General Partnerships formed in Delaware are required to pay the annual franchise tax by June 1. This method calculates the tax based on the number of shares your corporation has authorized. Your corporation will owe an estimated $85 for each 10,000 shares authorized. The minimum tax when using this method is $175, and the maximum tax is $200,000. While the former considers the total number of authorized shares to determine the tax, the latter bases it on the corporation’s total gross assets and issued shares.